Average tax rate formula

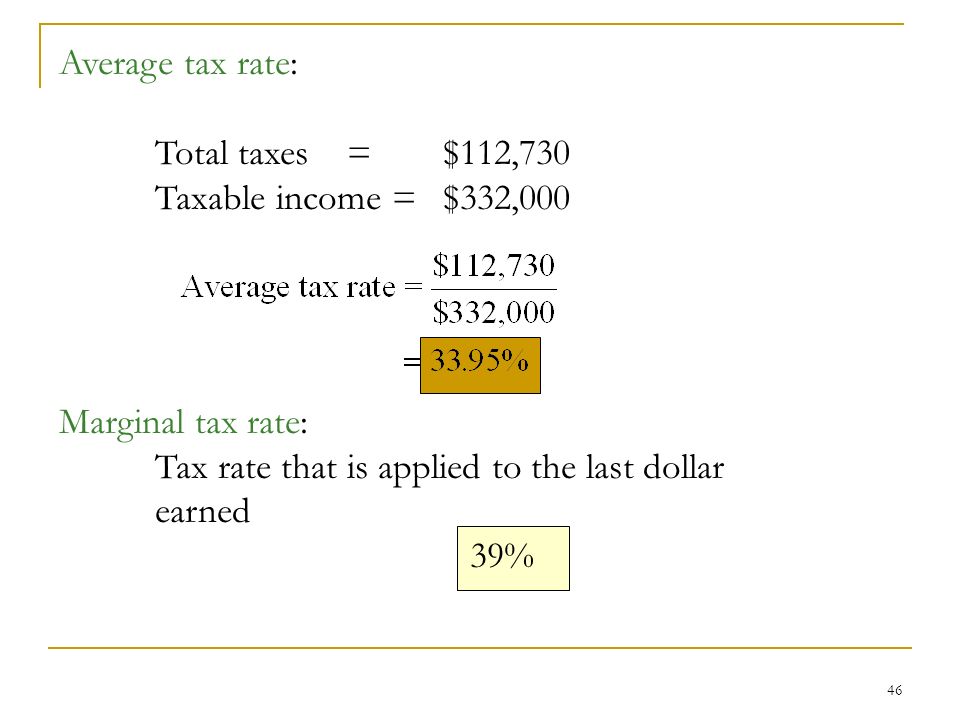

The average tax rate may be found via Form 1040 of the Internal Revenue Services IRS. The average tax rate is defined as total taxes paid divided by total income.

Marginal Tax Rate Formula Definition Investinganswers

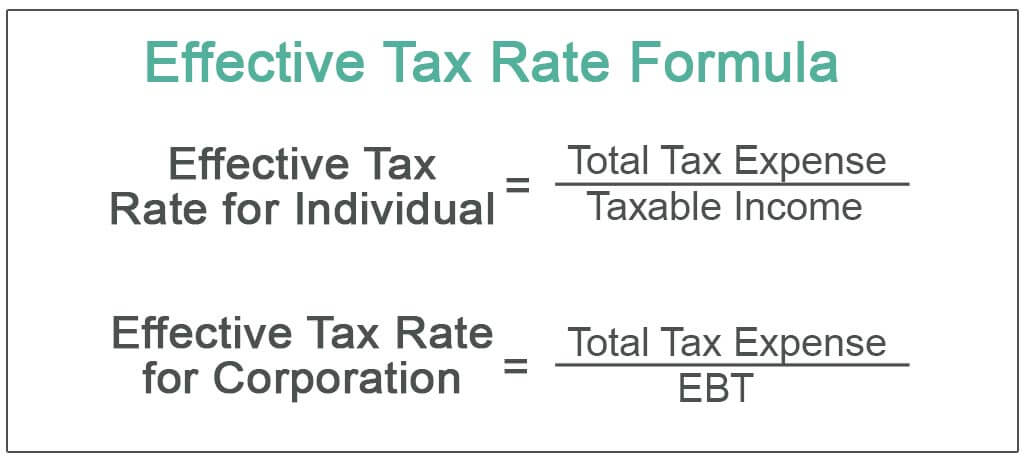

Effective Tax Rate Formula Effective Tax Rate.

. Every dollar they earn above their current bracket is taxed at the next one. The average tax rate equation begins with figuring. Cost of the item x percentage as a decimal sales tax.

Mathematically it is represented as Average Rate of Return formula Average Annual Net Earnings After Taxes Initial investment 100. For example if a household has a total income of 100000 and pays taxes of 15000 the households average. Tax expense is usually.

He gets a raise of 10000 bringing his income to 60000 per year. Alternatively the Marginal Tax Rate Formula is as follows. The average tax rate equals total taxes divided by total taxable income.

Earnings before tax EBT. Effective Tax Rate is calculated using the formula given below Effective Tax Rate Total Tax Expenses Taxable Income Effective Tax Rate 1573875 80000 Effective Tax Rate. Johns taxable income is 50000 per year meaning that his marginal tax rate will be 20.

Average Rate of Return formula Average. The average tax rate is the total amount of tax divided by total income. Ad Compare Your 2022 Tax Bracket vs.

For Individual A with a taxable income of 450000 the 28 would equate to 28000. For Individual X with the 38000 taxable income the tax for the said bracket would. For instance if Jimmy paid 1000 in taxes and his total income was 20000.

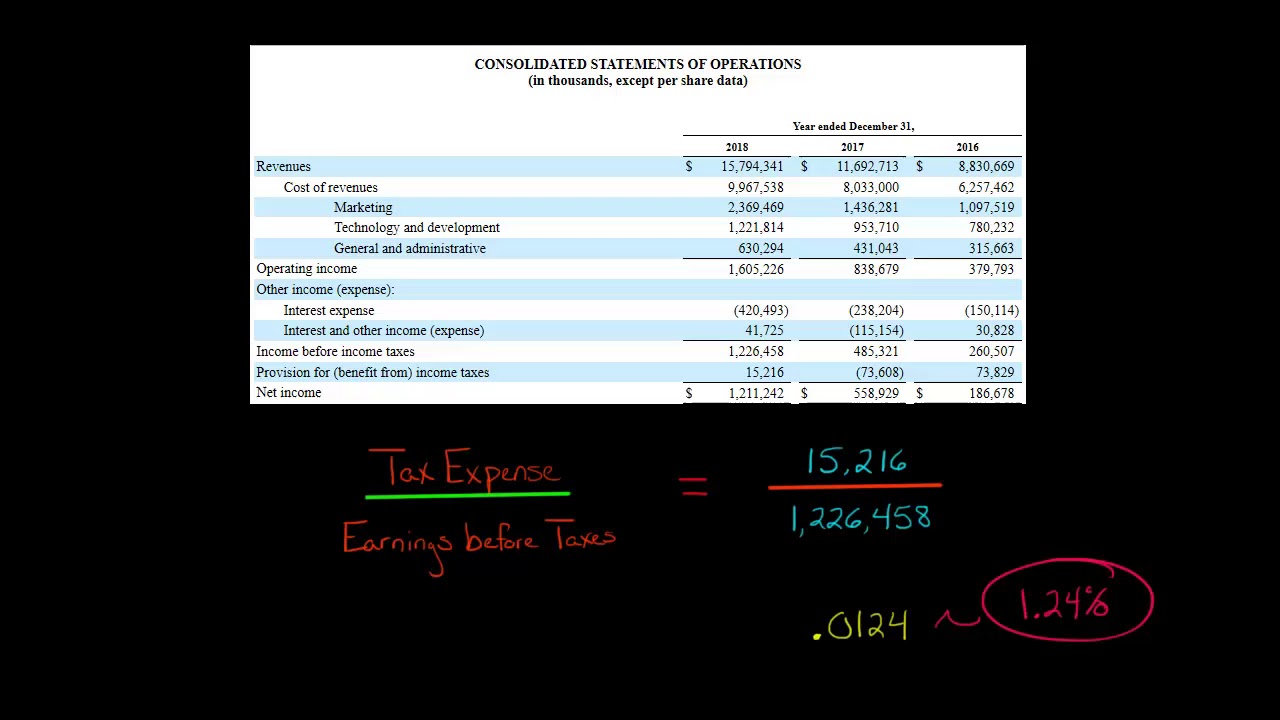

The most straightforward way to calculate effective tax rate is to divide the income tax expense by the earnings or income earned before taxes. Using the form simply locate the amounts for the total taxes line 24 and divide that by. Calculating the average tax rate involves.

Let us determine the tax rate for an individual with a taxable income of 600000 under the following hypothetical progressive tax regime. What is the formula for calculating the average tax rate. As per above table Total tax expense.

Your 2021 Tax Bracket To See Whats Been Adjusted. Calculating the average tax rate involves. Multiply retail price by tax rate Your math would be simply.

That means it describes what share of total income ultimately has to be paid in taxes. How do you calculate tax formula. Discover Helpful Information And Resources On Taxes From AARP.

Total Income Tax Taxable Income n x Tax Rate under a Tax Bracket m Taxable Income n1 x Tax Rate under a Tax Bracket. For example if a household has a total income of 100000 and pays taxes of 15000 the. The average tax rate equals total taxes divided by total taxable income.

To determine effective tax rate divide your total tax owed line 16 on Form 1040 by your total taxable income line 15. The effective tax rate can be calculated for historical periods by dividing the taxes paid by the pre-tax income ie. Lets say youre a single filer with 32000 in taxable.

The average tax rate is the total amount of tax divided by total income. The average tax rate can be calculated by dividing the total tax paid by the total taxable income. Your average tax rate is that number divided by your total income 85000 in this example and 14489 divided by 85000 is 17 percent.

Income Tax Formula Excel University

Effective Tax Rate Calculator On Sale 54 Off Www Ingeniovirtual Com

Chapter 01 Learning Objective 1 2 Marginal Average Tax Rates And Simple Tax Formula Youtube

Effective Tax Rate Definition Formula How To Calculate

Excel Formula Income Tax Bracket Calculation Exceljet

Federal Income Tax Calculating Average And Marginal Tax Rates Youtube

How To Calculate The Effective Tax Rate Youtube

Effective Tax Rate Formula Calculator Excel Template

Taxation 3 Ways Governments Can Bring In Revenue Which One Brings In By Far The Most Taxes Direct Indirect The Sale Of Goods And Services Ppt Download

Chapter 8 Accounting For Depreciation And Income Taxes Ppt Video Online Download

Effective Tax Rate Formula And Calculation Example

Marginal And Average Tax Rates Example Calculation Youtube

Effective Tax Rate Formula Calculator Excel Template

Marginal Tax Rate Bogleheads

Effective Tax Rate Formula Calculator Excel Template

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

Effective Tax Rate Formula Calculator Excel Template